- Event Business Intelligence

- Posts

- 7 Trends & Insights from IMEX, M&A Updates & More . . .

7 Trends & Insights from IMEX, M&A Updates & More . . .

Uncertainty Lurks Beneath A Sea of Optimism.

Whatever headwinds and uncertainty the events industry is facing, which I’ve chronicled repeatedly, they’re not reflected in the numbers at IMEX America this year. Carina Bauer and her team reported a record 17,633 attendees (6,145 of whom were buyers) and 3,700 exhibitors, and indeed the show floor was packed.

Optimism abounded. It felt like they were pumping serotonin into the Mandalay Bay ventilation system, as everyone was incredibly upbeat. [Having thousands of sales people all under one roof certainly helps, as they’re optimistic and outgoing by nature.] Under the surface, however, lied a layer of uncertainty and concern over the next 18 months. More on the industry’s mood dichotomy below.

In this issue:

Freeman Data Show Organizers & Attendees Not On Same Page

Update on The Hollywood Staffing Model

Skift M&A Session Video

2nd Agency Leaders Dinner Shows Continued RFP Challenges

A ‘War Zone’ Pavillion at IMEX 2026?

Industry Pulse & Insights from IMEX

PSA: Can We Please Get Rid of Smoking in Vegas Casinos?

If you’re not already subscribed, click here:

M&A Updates

Fort Point Capital has sold event activation firm EventLink Group to Serata Capital Partners and Paceline Equity Partners. Fort Point acquired Event Link in 2017, so this exit is a few years past the normal PE holding period. Look for more such exits now that we’re past the Covid disruption and buyers can see several years of earnings data.

EMC3 (which I recently learned stands for Every Moment Counts, thanks to partner Daniel Curtis) has acquired Boston | Austin Experiential Group, which will be organized under the new EMC3 Collective entity. This acquisition helps solidify the London-based firm’s already growing U.S. presence.

When 360 Destination Group and CSI DMC were both purchased by H.I.G. Capital earlier this year, it was apparent a rebranding under a single name was in the works. I assumed that would happen next year, but they launched the new brand, Cohera, at IMEX, with a reception and a beautiful booth (that I almost walked right by because I didn’t recognize the name). 360’s Trevor Hanks will be the CEO of the combined entity, and their board of directors includes industry veterans Scott Graff (former BCD Meetings & Events CEO) and Tony Lorenz (former PRA CEO). Look for additional acquisitions as H.I.G. builds onto this platform.

Closer Still has acquired Billington Cybersecurity, owner of a number of conferences and events in cybersecurity, whose flagship event in DC last month set a record with 3,000+ attendees. This is the 4th purchase by Closer Still this year, and 3rd in the U.S. The firm ranked 11th in the Stax list of largest global trade show organizers by revenue, up from number 14 in 2023, and they’re likely to move higher up in next year’s list once these purchases are digested.

Upcoming Events

Dec 2-4 I’ll be speaking on The State of M&A at ACCESS, the annual conference of EDPA (Experiential Designers & Producers Association), an organization comprised of companies that support the exhibition, experiential and event industry.

The Engage! Luxury Wedding Business Summit will take place Dec 8-11 at the Ritz Carlton Bacara in Santa Barbara, where I’ll be leading their first ever M&A session. For the unfamiliar, this is an incredible event that sells out within days of registration launching, despite its hefty $6,500 price tag. Rebecca Grinnals and Kathryn Arce have built something pretty incredible here.

The Hollywood Staffing Model - UPDATE

My last post on this topic addressed the growing trend of using contract staff to fill talent pools, particularly for event agencies, in response to unpredictable workflow. The article explored how we got here, pros and cons, and some best practices for going this route.

One glaring omission on my part was taxes, specifically the importance of ensuring you don’t run afoul of the U.S. Department of Labor and/or your local State Department of Labor.

To put it mildly, the government doesn’t like it when companies hire independent contractors that it thinks should be treated as employees. They want you withholding and remitting income tax, paying the employer’s share of FICA and Medicare, and covering the minimum premiums for unemployment insurance, disability insurance and workers comp. No one wants to go through an audit. Even if they find no fault, the accountant fees can be significant, to say nothing of the time suck it will be for the firm.

The IRS lists the criteria for testing which category workers fall into. Some staffing agencies, like Encore Nationwide, pay their people as W-2 employees, which is probably the safest route, though it may make them appear more expensive in the short run. Others, like Plannernet, require all their workers to set up their own companies, and issue them 1099s at year end. If you’re hiring staff from an agency, it’s worth asking how they address the payroll tax issue.

Skift Meetings Forum: M&A Session Video

I’ve gotten some nice positive feedback on my M&A session at Skift Meetings Forum last month, Mastering the Exit Strategy: Insights On Selling Event Businesses, from a number of senior business leaders I greatly respect, including Janet Traphagen (CEO at Creative Group), Carvie Gillikin (CEO at MGME), and Trever Acers (Managing Director and Partner at Objective, the investment bank that advised 360 Destination Group on their sale to HIG Capital).

The full video of the 15 minute session can be viewed below. And for the record, my hair isn’t really that white/gray. Is it? #AgingGracefully?

2nd Agency Dinner | RFP Challenges

The evening of the Skift Meetings Forum I hosted another dinner for a group of event agency C-suite leaders in NYC, including Colja Dams of Vok Dams, Liron David of Eventique, Jill Taub Drury (of Drury Design), J.B. Miller (of Empire Entertainment), Maureen Ryan-Fable (of FIRST), Brendan Brown (of George P. Johnson), and Daniel Curtis (of EMC3).

Someone ordered a drink (I forget what), and the person sitting next to them grimaced, saying the last time they drank that they got so sick that they’ll never drink it again. Upon which, someone else had the brilliant idea of making that an ice-breaking question when we went around the room, which was a first for me, and I assume everyone else. My answer, in case you were wondering, is an Alabama Slammer, which I last had when I was 18 years old, and the thought of which still makes me a tad queasy.

Anyway, once again the dominant topic was the RFP process, with which everyone voiced frustration. RFPs going to too many agencies, creative ideas being stolen, lack of response or feedback, etc. I’ve had these sentiments come up organically in a half dozen other agency leader conversations over the past month as well, so this is clearly a process in need of an overhaul. I’d like to help facilitate a dialogue between the various constituents (agencies, clients, procurement) over the coming months, where we can agree on, and disseminate, best practices for the industry. Stay tuned.

IMEX Insights

IMEX America is the meeting and event industry’s pep rally, a singular gathering point for thousands of professionals to come together to learn, do business, network, and, perhaps most of all, replenish our love and enthusiasm for the industry. No other event has such gravitational pull, and the critical mass it draws provides a platform for product launches, press announcements, side events, and shows of strength and relevancy amid a sea of disruption. Even if you don’t have any meetings here, it’s a place to feed your ‘professional soul.’

1. Growing Concerns Underlie Record Numbers

This year’s show boasted record numbers across the board, reflecting the huge resurgence of face-to-face events as the premium vehicle for engaging with customers, employees, members and other constituencies. And as I mentioned above, optimism and enthusiasm abounded.

Still, there was something incongruous about the record attendance juxtaposed against ten months of ongoing disruptions and revenue unpredictability - in the U.S. at least. Off the record, the majority of people I spoke to were nervous about 2026 and beyond. My guess is that many of the exhibitors had already committed before things got wonky, and if the situation continues like this, I’d expect next year’s attendance numbers to drop a bit.

That said, today’s event industry is far more resilient than the one that faced Covid over five years ago. The ‘deer in the headlights’ paralysis or panic has been replaced by agility, adaptability, and the earned confidence of having navigated multiple disruptions.

2. AI As A Bulwark Against Increased Costs?

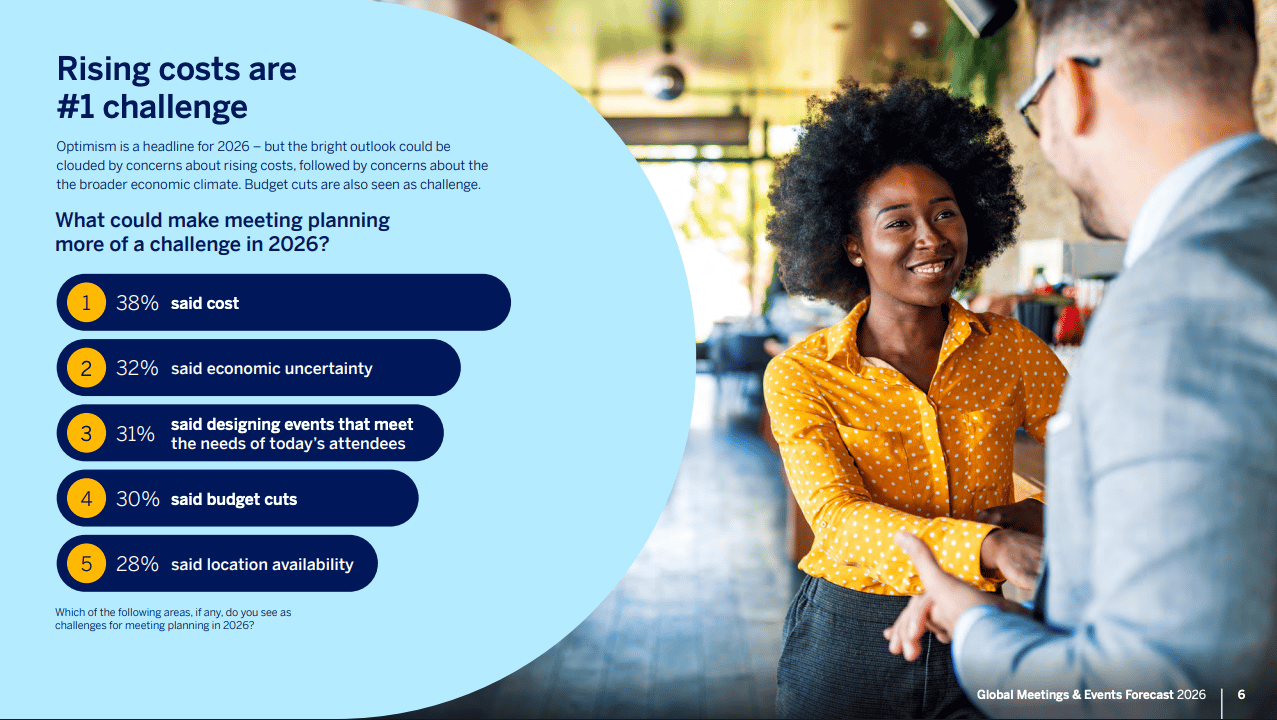

A few themes emerged from the session content, one of which is that costs are a significant concern. [Then again, when are they not? I can’t remember ever seeing headlines about ‘decreased costs’.] In Amex GBT’s 2026 Global Meetings & Events Forecast, released at IMEX, 68% of planners cited increased costs or budget cuts as their top challenge, with 71% expecting costs to increase next year.

Source: Amex GBT 2026 Meetings & Events Forecast

Another is the challenge of recruiting, nurturing and retaining good talent. [Again, hasn’t this always been a bit of an issue?]

AI continues to be seen as a solution to combat these two struggles, though adoption is definitely mixed. Those organizations, teams and individuals who are leaning into experimenting with AI and integrating it into their workflow are notching strong gains in productivity, which not only offset the above cost and staffing challenges, but also enable them to elevate the quality of their work.

3. A ‘War Zone’ Pavilion In 2026?

My heart went out to the DMOs and businesses manning the huge booths from Chicago and Washington, D.C. It’s gotta be rough to have the President of the United States tell the world that your city is a war zone, saying crime is so out of control as to require deployment of the National Guard. Virtually everyone I spoke to acknowledged that the deployments were largely performative, but still.

As if that wasn’t enough, DC is bearing more of the brunt of the government shutdown than any other U.S. city.

For the record, both are great places to host meetings and events, and Choose Chicago and Destination DC are excellent DMOs, led by Kristen Reynolds and Elliott L. Ferguson, II, respectively.

Given Trump’s eagerness to play Risk with the country, moving troops hither and yon, will next year’s IMEX feature a ‘War Zone’ grouping on the show floor of cities with a National Guard presence? In addition to DC & Chicago we could include Portland, Memphis, and (judging by his social media musings) San Francisco and New York. #GallowsHumor

4. Organizers & Attendees Are NOT On the Same Page

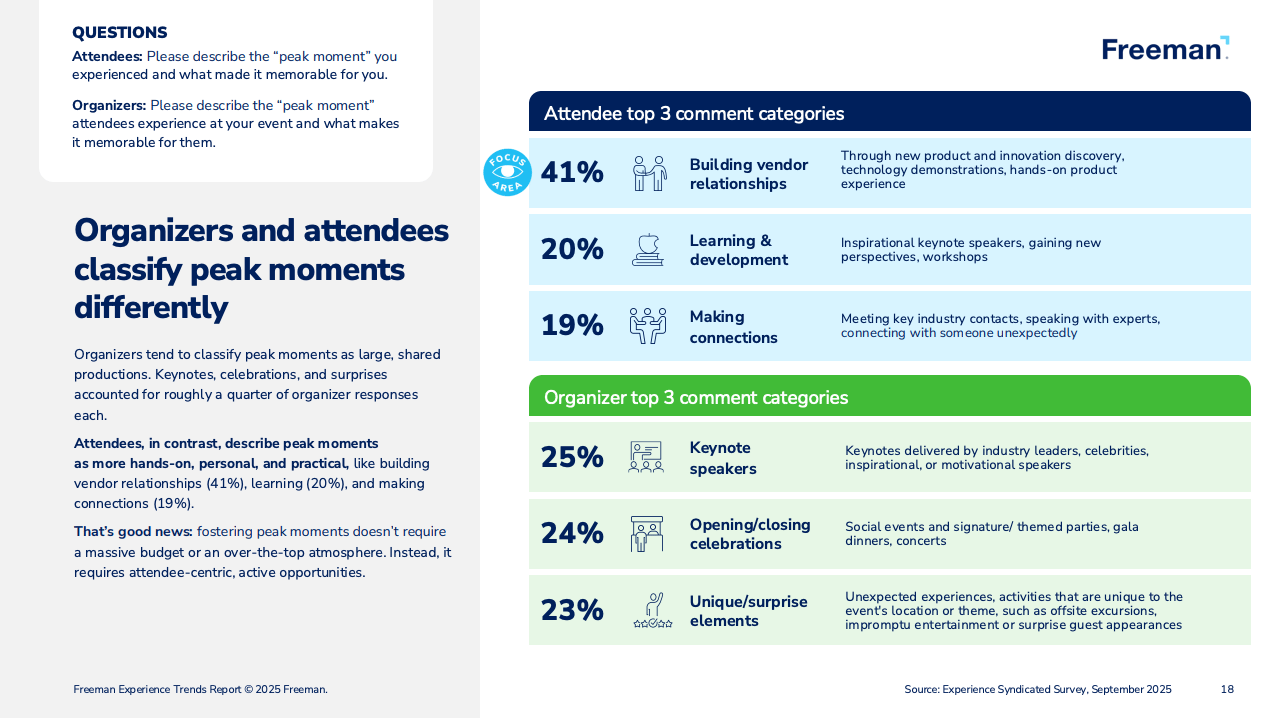

Among other things, IMEX is ground zero for organizations releasing new research, and one I look forward to is Freeman’s bi-annual report, for two reasons. One, Freeman is an industry behemoth, and as such has access to a mother lode of exhibitors and attendees to survey. Two, I can always count on Ken Holsinger’s team to sift through the reams of data and divine key trends I need to know about.

One thing that stuck out to me in is the perception gap between what organizers think are the most important aspects of their events and what attendees actually say it is. When asked whether attendees experienced a ‘peak moment’ at their event, 78% of organizers said yes, compared only 40% of attendees, nearly half as many.

That’s a huge problem for organizers, who need to stop drinking their own Kool-Aid. A core reason for this is that the two sides define ‘peak moments’ differently. As the chart above shows, attendees focus on building vendor relationships, learning & development, and making connections, while organizers are still caught up in keynote speakers and opening/closing ceremonies. In other words, organizers focus on style, attendees on substance. Freeman uncovered this data a couple of years ago, but organizers still seem slow on the uptake.

5. M&A On the Rise

On Tuesday morning SITE hosted a C-Suite Summit for Incentive Agencies at the MGM Mansion, a venue that feels more like a luxury wellness retreat than anything remotely resembling a casino hotel, with the meeting taking place in a stunning outdoor (a rare treat in Vegas) Tuscan-style courtyard. SITE CEO Annette Gregg pulled together a hand-picked group of 25 or so agency leaders, all of whom were incredibly open and vulnerable, sharing insights and exchanging ideas.

I was asked to deliver a session on The State of M&A for agencies, which I’ll share more about in the next article. But the key takeaway from me was how many agencies are actively looking to acquire others, and/or have already done so. The level of business sophistication is markedly more advanced than it was ten or even five years ago.

6. How Long Does It Take to Walk the Full Show Floor?

Anyone who’s been to IMEX knows the challenge of getting to meetings in different sections of the show floor on time, particularly when you’re coming from an area on the other side. IMEX is big, and traversing the floor always takes longer than you think, and that’s without factoring in time for bumping into people you haven’t seen in a while.

I ran into Skift Editor-in-Chief Miguel Neves at one end of the convention center as he was preparing to time himself crossing it’s full length, and we made a bet. I guessed it would take 7 minutes. It took 6:07 (though I think he walked fast to ensure he won). Check out his fun video documenting his journey.

7. PSA: Can We Please Get Rid of Smoking In Vegas Hotels?

Las Vegas casinos seem to be the only remaining places where people are allowed to smoke in public. Why, I have no idea, but it’s long past time to ban it altogether, or at the very least sequester the smoking in dedicated areas, like they do at the Vegas airport.

I’m pretty libertarian in my views, and think adults should be allowed to do what they want as long as it doesn’t hurt or bother anyone else. Smoking in public doesn’t fall into that category, however, as it’s irritating to many people. Around 10% of U.S. adults have asthma, and many others just don’t like breathing in cigarette smoke. In my case, I had 18 rounds of radiation on my right eye, and the smoke in casinos makes my eye feel like it’s burning. I suppose I could wear an eye patch - who doesn’t want to be a pirate, right? - but is that really what it’s come to?

Non-smokers should be able to enjoy the casinos without having to breath in heavy smoke. Even if you don’t gamble, in most Vegas hotels you have to walk through the casino to get to the elevators to the rooms. I stayed at the Conrad a few years ago, and it was such a pleasure to be able to go to the elevator without passing the casino. Even there, though, you couldn’t get to the restaurants or shops without walking through the smoky casino. But the Conrad is the exception, not the rule.

I assume the reason hotels continue to allow smoking in their casinos is because smokers are big gamblers, but I think that’s a misnomer. Every time I walk through a casino I see very few people actually smoking. I would imagine Vegas hotels that provide clean, breathable air in their casinos would be richly rewarded with increased gambling from non-smokers.

Thank you for attending my TED Talk.

Here’s to taking your event business to the next level!

Howard Givner

Senior Advisor | Oaklins: DeSilva & Phillips (M&A) email me

CEO | Heathcote Advisory Group (Consulting) email me

Thanks for reading! Please give me feedback by hitting reply.

Catch up on recent articles:

If and when you’re ready, here are ways I work with event business owners:

Business Coaching & Owner Accountability

Business Diagnostic & Company Valuation

Growth Consulting

Exit Planning

M&A (Buy Side & Sell Side)

Wanna chat? Email me, or schedule an intro call.

If you were forwarded this email and would like to get new weekly articles, click her to subscribe for free: